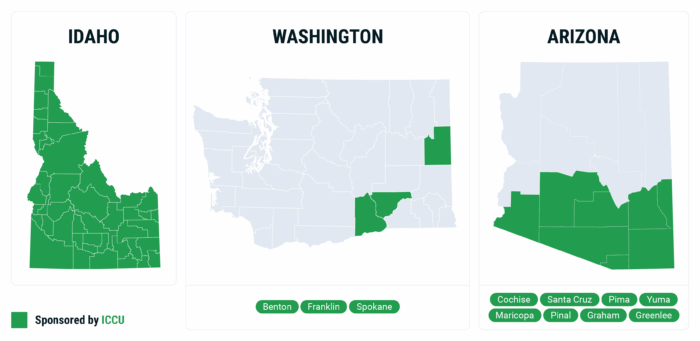

ICCU has partnered with Stukent to provide high school students in Idaho, Eastern Washington, and Southern Arizona with FREE access to the Stukent Personal Finance Simulation. This simulation gives high school students hands-on experience with essential personal finance skills, including budgeting, paying bills, investing, and more.

ICCU’s support has already given more than 17,000 students across 200 schools hands-on experience with money management, setting them up for lifelong success. It’s just one of the many ways ICCU helps communities succeed, one classroom at a time.